At least one of the main stream media, the Washington Post (which is turning into a legitimate news source) conducted an interview with the top ratings mucky muck at Standard and Poors who laid out their view on the budget deal. The bottom line here is that the gravy train of no accountability, no consequences spending is over.

S&P managing director John Chambers said in an interview … even if the parties agree to raise the debt ceiling, it may not be enough to avert a downgrade. Chambers said the country must implement a plan to reduce the annual budget deficit by roughly $4 trillion over 10 years, which makes the debt manageable over the long term. The White House and Congress have discussed a plan that big, but negotiations have more recently centered on a smaller deal, at $2 trillion or less. “That could still lead to a downgrade,”Chambers said.

The credit agencies have to be looking at FY 2012 (Sept), where the projections are currently forecasting about a $1.1 trillion deficit. You should understand that the FY 2012 is rife with phony assumptions, such as over $2.5 trillion in tax revenues coming from a robust economy, and the end of a number of so-called temporary programs. FY 2011 will be lucky to collect $2.1 trillion, and apparently tax increases aren't in the works, so it is entirely unclear what this healthy boost of revenues is based on.

Another example is the 30% reimburshment cut to physicians under Medicare. There are also presumptions on non-provider reimbursement. The chances of this anti feeding-at-the-trough provision going through is as about as likely as pigs flying, so we will see a large readjustment in the deficit the general fund is using to fund the excess Medicare and Medicaid spending. If this goes through, then the general fund will balloon out beyond the $1.1 trillion projection. In other words, the cost-cutting measures in Obamacare get gutted, more people come into the system for health care and costs escalate.

There is controversy on how to budget for the housing agencies: CBO says $317 billion, OMB says $130 billion. Both of these were presumed on housing prices stabilizing, which now is problematic.

Another element, not surprisingly, is that under the stimulus, state and local governments were given federal grants equal to one-third of the state budgets. This was used to close budget gaps, cover Medicare spending, expand food stamp programs, and for maintaining bloated workforces and pensions (where contributions were also sometimes kicked down the road). So there may be a state crisis tempting some sort of new bailout that takes the U.S. into the European bailout pattern, with additional costs in the hundreds of billions.

In addition, as a facilitation to maintaining unemployment insurance, the states have utilized a little discussed credit line from the Federal government The balances are currently $40.5 billion owed by the states. The Federal loans to support the State Unemployment Trust Fund remained interest free through Dec. 31 of last year, but interest began to accrue on Jan. 1, 2011. The first interest payment will be due on Sept. 30, 2011. Will the Federal Government defer this, too? If not, it will be just one more burden on the states.

The FY 2012 budget presumes that the one-year unemployment extension to 99 weeks will go away. If it does, then 6.7 million quasi-permanent unemployed will fall off of benefits, resulting in a hard to imagine amount of distress, disorder and rioting. The cost of the 73-week extension beyond the traditional 26 weeks is $100 billion.

The 2% payroll tax reduction was designed as a one-year stimulus and will automatically expire at the end of 2011. Its extension, the cost of which is $120 billion, is not included in the $1.1 trillion FY 2012 budget. Are they going to roll the dice on this one again?

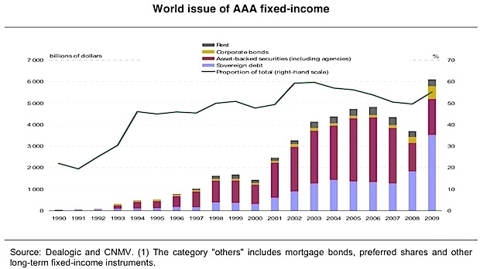

On the question of does a downgrade matter, keep in mind that many investing entities are mandated to buy AAA government debt. Felix Salmon wrote a great piece pointing out the bloated supply of AAA rated debt around the world. Much, if not most of this debt represents sovereign obligations or implied guarantees, which is the rub to the whole Ponzi pyramid.

In a nutshell, triple-A debt is dangerous; there’s far too much of it; its growth seems out of control; and the triple-A problem has now become a sovereign-debt problem, in a world where sovereign-debt crises are the most damaging crises of all.

This edifice blows apart once there are actually defaults and as importantly downgrades of the so called AAA debt structure. This chart is actually dated considering the three trillion in additional US AAA debt that has been issued since the financial crisis. Therefore as an event horizon US credit downgrades will be a big event. And once the big event occurs, the near free financing ability of the US dissipates. At current debt levels of $14.5 trillion, every one percent increase in interest costs translates into $145 billion. This could easily create a pile on effect or debt trap that is crippling the PIGGS.

No comments:

Post a Comment